Welsh farming unions have welcomed a cross-party report criticising the UK Government’s approach to proposed inheritance tax changes, warning that rushing ahead could put family farms across Wales at risk.

The Welsh Affairs Committee published its report last week following an inquiry into the challenges facing farming in Wales. Among its key recommendations is a call for the UK Government to delay implementation of reforms to Agricultural Property Relief (APR) and Business Property Relief (BPR) until a Wales-specific impact assessment has been conducted and scrutinised.

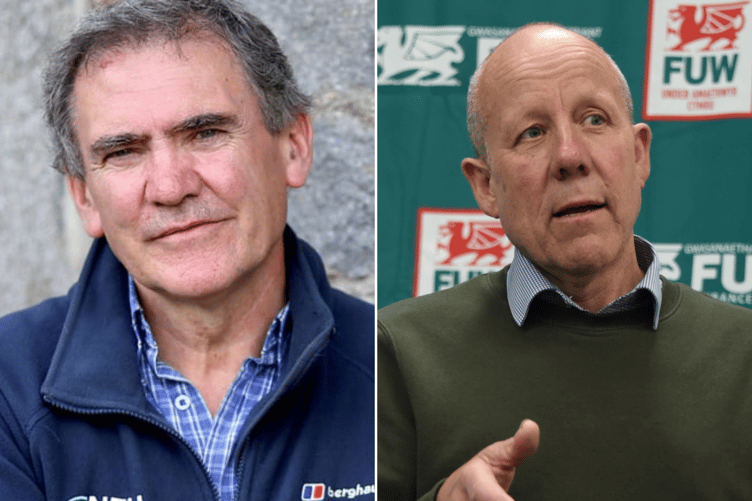

Reacting to the report, FUW President, Ian Rickman said: “This report sends a clear and timely message to the UK Government that Welsh farming cannot continue to be treated as an afterthought in Whitehall. The Committee has rightly recognised the unique nature of agriculture in Wales; its scale, its contribution to our economy, and its vital role in sustaining our rural communities. Yet too often, UK policy fails to take those distinct circumstances into account.

"The proposed inheritance tax changes and the ‘Barnettisation’ of agricultural funding both risk undermining the long-term sustainability of Welsh family farms at a time when the industry is already under a perfect storm of rising costs, volatile markets and future uncertainty.

"As we approach the Autumn Budget, the Chancellor must take these findings seriously and ensure that future decisions genuinely protect our family farms, strengthen food security, and secure a sustainable future for Welsh agriculture.

“We thank Members of the Welsh Affairs Committee for providing an accurate and well-balanced report on the current situation of Welsh farming, and for highlighting the urgent need for the unique characteristics of rural Wales to receive certain consideration when policy decisions are made.”

NFU Cymru President, Mr Aled Jones said: “I am heartened that so much of the detail presented by NFU Cymru in its evidence to the inquiry, highlighting the significant concerns of members across Wales, has been reflected in the committee’s report, its conclusions and recommendations.

“Over the last 12-months, some of the most difficult and heart-rending accounts which have been shared with me involve elderly farmers or those with terminal illness. Many of these farmers have arranged their affairs on the basis that their estates would not be subject to inheritance tax but now they stand to be disproportionately affected by this policy, as they simply do not have the time left to make alternative succession arrangements. I take comfort that the committee has also identified this as an area of concern.

“The committee’s report challenges the Treasury’s assessment of the number of farms likely to be affected by the inheritance tax policy changes on the basis that these general indications of farm values are produced in the absence of key information concerning individual businesses, which could lead to a ‘misleading’ picture. This lack of precision in the Treasury data is further compounded by the lack of Wales level data. I remain firmly of the view that far more farms will fall into the scope of this new tax than the Treasury claims.

“NFU Cymru firmly supports the committee’s recommendation to UK Government calling for a delay to the APR and BPR reforms until a Wales specific impact assessment has been published and scrutinised by the committee. We also concur with the recommendation for a revisiting of all the available data relating to farm ownership in Wales to develop a more detailed understanding of the potential impact that changes to inheritance tax may have on farmers in Wales. I urge the UK Government to heed this advice rather than hurtling headlong into a policy which we know gives rise to a range of negative and unintended consequence.”

The release of the Welsh Affairs Committee’s report arrives just two weeks ahead of the UK Government’s autumn budget announcement on Wednesday, November 26. Many of the conclusions and recommendations contained with the report – including the request for a pause in the rollout of the inheritance tax changes - echo those of another House of Commons Cross-party committee, the Environment, Food and Rural Affairs (EFRA) Committee.

Mr Jones said: “I commend the committee for quickly getting to the nub of what is a complex issue. What makes this report particularly powerful is the fact that a committee with a diverse, cross-party membership, has been able to reach an unanimous view with regards to conclusions and recommendations about the truly damaging impact of the UK Government’s inheritance tax policies on Wales’ family farms - and the need for a delay.

“It is clear to me that when MPs, no matter what their political party, sit down and consider in detail the impact on ordinary farmers of the government’s inheritance tax policy proposals, they recognise and understand the inadvertent consequences of the proposed changes. They have reached the view that a pause and review of the policy is needed to better understand its impact on farming families and to look at alternatives.

“Ahead of the budget later this month - and in light of the Welsh Affairs Committee’s report - NFU Cymru is repeating its call to the Chancellor to recognise the uniqueness of Wales’ farming sector, its multi-generational nature and its importance to Wales’ culture and economy. There must be a pausing and reviewing of this policy to look at its unintended consequences and to consider some of the other proposals which have been put forward.”

Comments

This article has no comments yet. Be the first to leave a comment.