An impactful NFU Cymru display at the Royal Welsh Winter Fair has encapsulated rural Wales’ opposition to the UK Government’s inheritance tax reforms ahead of the Autumn Budget.

More than 400 Winter Fair-goers each played their part in the visual spectacle on the second day of the Royal Welsh Winter Fair in Llanelwedd today (Tuesday).

The mosaic message - spelling out ‘NO IHT’ – was delivered just a day before the Chancellor’s Autumn Budget announcement and signalled the strength of feeling amongst rural communities against the UK Government’s planned changes to inheritance tax reliefs.

The Winter Fair display is the latest activity in a long line of campaigning activity conducted by the union since the proposed changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) announced last year.

On the eve of the 2025 Autumn Budget statement, NFU Cymru is calling on the UK Government to follow the recommendations of the cross-party House of Commons’ Welsh Affairs Committee, which is seeking a pause in the implementation of the policy to enable a full impact assessment of the effect on Welsh farming.

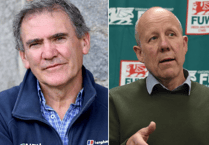

Speaking after the display, NFU Cymru President Aled Jones said: “Today’s campaign activity is an unequivocal statement from rural Wales – ‘The UK Government’s reforms to inheritance tax reliefs are going to be devastating for Welsh family farming businesses and the prosperity of our rural areas’. It is over a year since the Chancellor’s original announcement and we are still hearing of families whose lives will be turned upside down by these changes. At a time when families will be mourning the loss of a loved one, they will also be weighing up how to dismantle their farming business in order to pay a tax bill they were told they’d never have to pay.

“The biggest frustration for so many farmers is that the UK Treasury has been served a raft of evidence – from tax experts, the wider supply chain and cross-party MP committees – that the consequences of these changes will be catastrophic. The idea that UK Government can continue with these changes despite such a resounding volume of concern and worry is extremely troubling. We must see a pause to the family farm tax until those impacts are properly accounted for.”

Comments

This article has no comments yet. Be the first to leave a comment.